The Missing Link: Local Authorities as Catalysts for Pension Investment in Communities

Introduction: What if Your Pension Could Build a Better World?

As I talked about in my previous post about the quiet pension fund reform Most of us think of a pension fund as a giant savings pot, a pool of money from thousands of people that is carefully invested to grow over time, ready for retirement. But what if that giant pot of money could do more than just grow? What if it could also be used to build new homes, create jobs, and improve your local community?

This isn't just a hypothetical question. One of the UK's largest pension funds, the Greater Manchester Pension Fund (GMPF), is doing exactly along with their partnered Greater Manchester Combined Authority (GMCA) to channel billions into local housing, infrastructure, and enterprise. This collaboration shows why local government is the essential bridge: it identifies priority projects, shapes investable propositions, and provides the democratic legitimacy that pension trustees need to deploy capital confidently.reporting on it too through it's partnership with The Good Economy (You can find the report here).

Through this partnership, GMPF is proving that place-based impact investing (PBII) can deliver twin aims: strong financial returns and measurable social value. And thanks to transparent reporting frameworks like those developed by The Good Economy we can see the results—thousands of homes, jobs, and community assets delivered across the region.

This article is based on the report here which was published in October 2024 and tries to articulate how that model works, why it matters, and what lessons other councils and LGPS funds can take from Greater Manchester to scale this approach nationally. It is timely in relation to the huge policy reforms taking place, not just in LGPS but wider local government reorganisation and devolution and hopefully we can begin to demystify this ecosystem to build PBII into the future of our place partnerships both public and private.

Understanding "Place-Based Impact Investing"

Place-Based Impact Investing (PBII) is a strategy that aims to generate positive, measurable benefits for a specific geographic area alongside a financial return. Think of it as investing in your own areas success. Instead of sending money to far-off companies (mostly outside of the UK), PBII channels it into local projects that respond to locally identified needs and directly benefit the people who live there.

The Greater Manchester Pension Fund's approach is guided by two clear and equally important goals, which can be thought of as "Twin Aims."

Aim | Simple Explanation |

Financial Return | To grow the pension fund's money so it can pay its members' pensions in the future. |

Positive Local Impact | To use the money to create tangible benefits like jobs, housing, and services for the local area. |

Meet the Investor: The Greater Manchester Pension Fund (GMPF)

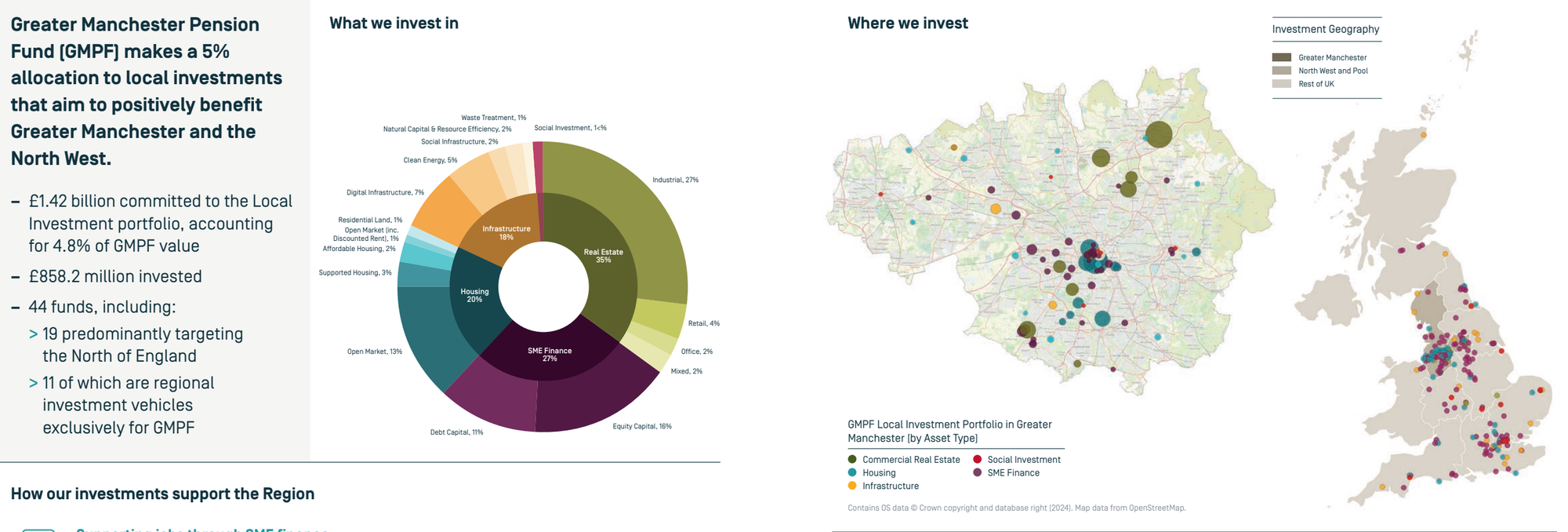

The Greater Manchester Pension Fund (GMPF) is the largest local government pension fund in England and Wales, managing an impressive £29.5 billion as of December 2023. For over 25 years, GMPF has made local investment a key part of its strategy.

The fund has a specific goal to allocate up to 5% of its total value to these local investments. But why do they do this? The reason is rooted in what you would call "democratic legitimacy." (We definitely need more of this!!!!). This strategy is meaningful in Greater Manchester, a region that, despite its economic growth, faces significant challenges with poverty and deprivation and like many areas of the UK are not seeing connection between political promise and how it affects their day to day lives positively. By investing locally, GMPF becomes part of the solution.

Since the vast majority of GMPF's members live and work in the region, investing in local projects aligns the fund's financial success with the health and prosperity of its members' own communities. When local businesses thrive and neighborhoods improve, the fund's members benefit not just as future retirees, but as citizens.

So, where does this money actually go?

A Look Inside the £1.42 Billion Local Portfolio

As of December 2023, GMPF has committed £1.42 billion to its Local Investment portfolio. This isn't just a number; it represents a powerful commitment to regional growth.

The portfolio has a sharp geographic focus. A full two-thirds (66%) of the investment is located in Greater Manchester and the wider North West, grounding the investment directly in the local area.

The money is spread across several key sectors, each designed to make a different kind of positive impact:

- Fueling Local Enterprise: GMPF provides vital funding to local small and medium-sized businesses, the very backbone of the community, helping them expand, innovate, and create stable jobs for your neighbors.

- Building Spaces for Business: The fund develops modern offices and industrial sites, creating the physical spaces where local companies can thrive, operate, and employ more people.

- Creating Homes for the Community: This focuses on building a wide range of homes, responding directly to the housing needs of people across the region.

- Powering Modern Life: This involves building the essential services of the 21st century, from high-speed internet that connects us all to clean energy projects that protect our planet.

These investments aren't just lines on a spreadsheet; they are producing tangible results that you can see and feel in the community.

The Results: Making a Real Difference in the Community

The impact of GMPF's £1.42 billion local commitment is significant and wide-ranging. The investments have produced real, measurable outcomes that strengthen the region's economy and improve people's lives.

Here are some of the headline results:

- Supporting Local Jobs: In total, GMPF's investments have supported nearly 19,000 jobs and helped create over 6,300 new ones, with a third of these new jobs located in the North West.

- Building Needed Homes: The fund has invested in over 3,500 homes, with the majority (64%) being built in the North West.

- Creating Community Hubs: The portfolio has helped create vital social infrastructure, including 6 nurseries, a school for children with special needs, and a primary healthcare facility.

- Powering a Greener Future: Investments have been made in 8 clean energy assets, including a windfarm capable of supplying clean power to 13,500 homes.

Meet the Enabler: The Greater Manchester Combined Authority (GMCA)

The Greater Manchester Combined Authority (GMCA) is the strategic body that brings together the ten local councils of Greater Manchester under a single governance framework, led by the elected Mayor. Its mission is to drive inclusive economic growth, improve housing and transport, and tackle social challenges across the city-region.

GMCA plays a critical enabling role in the deployment of GMPF’s local investment capital. Why? Because pension funds need more than money—they need investable projects aligned with local priorities and backed by credible delivery partners. GMCA provides that bridge by:

- Identifying priority sectors and sites through its spatial framework and economic strategy.

- Co-designing investment vehicles with GMPF, such as joint housing and regeneration funds, to crowd in private capital.

- Offering democratic legitimacy and policy alignment, ensuring that investments deliver both financial returns and social value for the region.

This partnership is what makes Greater Manchester a benchmark for place-based impact investing: GMPF brings patient capital, GMCA brings the pipeline and governance, and together they turn pension savings into tangible community outcomes.

Stories from the ground

Where is this actually making a differenc you may ask? This is the litmus test and should be the benchmark for how we adopt this to scale over the UK. There are real tangible results we should definitely be shouting about and building on.

- Preventing homelessness with permanent homes. GMPF committed £20m to the National Homelessness Property Fund 2 (NHPF2) managed by Resonance—buying and refurbishing homes across Greater Manchester for people facing homelessness, with wrap‑around support via partners like Let Us. [resonance.ltd.uk], [resonance.ltd.uk]

- Scaling affordable housing in the North West. In 2025, GMPF committed £100m through a North‑West “sleeve” of the Legal & General Affordable Housing Fund, accelerating delivery of sustainable affordable homes in the region and designed with the Northern LGPS in mind. [impact-investor.com]

- Homes & community assets. GMPF‑backed investments have supported 3,752 homes completed, in development or planned—~76% in the North West—plus seven nurseries (646 childcare places), one SEN school (60 places), and a primary healthcare facility serving ~13,500 residents. [thegoodeconomy.co.uk]

- Digital connectivity & clean growth. Four digital infrastructure assets (two operating in the North West) now reach ~233,000 premises; the portfolio also includes multiple clean energy and natural capital assets. [thegoodeconomy.co.uk]

- Jobs & enterprise. SME finance has supported ~15,300 jobs and created ~3,900 new jobs, with ~43% of new roles in the North West; GMPVF and commercial sites support ~8,500 jobs capacity, ~84% in the North West. [thegoodeconomy.co.uk]

Why Local Government Makes It Possible

The success of GMPF’s local investment strategy isn’t just about capital, it’s about collaboration. The Greater Manchester Combined Authority (GMCA) plays a pivotal role by creating the conditions for investment through its Integrated Growth Pipeline, Housing Strategy, and Growth Locations plan. These frameworks identify priority sites, align them with transport and energy infrastructure, and provide governance through the Local Growth Assurance Framework.

GMCA’s ability to structure finance such as mezzanine loans in housing projects has been critical in unlocking pension fund participation. Delivery vehicles like the GM Development Forum and the proposed GM Delivery Vehicle further de-risk projects and crowd in private capital. In short, GMPF’s £1.5bn local portfolio is possible because GMCA turns policy into investable propositions, proving that local government is the essential bridge between patient capital and place-based impact. [democracy....-ca.gov.uk], [greaterman...-ca.gov.uk], [greaterman...-ca.gov.uk]

The bottom line: doing good and doing well

GMPF’s Local Investment strategy shows that place‑based portfolios aligned with strategic authority delivery can deliver meaningful local outcomes while staying anchored to clear financial benchmarks, robust governance, and transparent reporting using The Good Economy’s PBII framework. [thegoodeconomy.co.uk], [thegoodeconomy.co.uk]

Next up: Lessons for Local Government: A practical playbook (Greater Manchester as the benchmark)

If you’re a council, combined authority, or LGPS fund looking to replicate GMPF’s approach, I'll be talking about how we might pput this into practice in the next blog. Stay tuned...

Notes on updates since the published GMPF Report

- Updated fund size (AUM), portfolio commitments/invested amounts, and geographic concentration using GMPF’s 2025 PBII report and 2024 Statement of Accounts. [thegoodeconomy.co.uk], [tameside.m...ngov.co.uk]

- Refreshed impact metrics for homes, nurseries/places, digital reach, and jobs to Dec 2024 data. [thegoodeconomy.co.uk]

- Clarified financial benchmarks and included recent IRR evidence from Good Economy/GMPF reporting and sector coverage. [thegoodeconomy.co.uk], [www.newpri...arkets.com]

- Replaced the single‑site nursery anecdote with portfolio‑level figures to stay fully evidence‑based; added NHPF2 and L&G North‑West examples for specificity. [resonance.ltd.uk], [impact-investor.com]